#4 Tax Planning Issues

This is a series about the 6 key things to consider before you retire. If you would like to consider building a personalized Prosperity Financial Plan, don’t hesitate to reach out. Schedule a Meeting

#4: Tax Planning Issues

As retirement approaches, strategic tax planning becomes a critical lever for preserving wealth, managing cash flows and optimizing long-term financial outcomes. Converting less-liquid assets into cash needs to be done with a tax plan in mind. We’ve already talked about asset location and how important that can be to minimize taxation. Other tools include tax-loss harvesting, charitable gift giving, gifting strategies and estate tax planning (which is especially important depending in your state of residence). We will pre-plan for you as much as possible, knowing that financial situations change and that we will flexible enough to account for those.

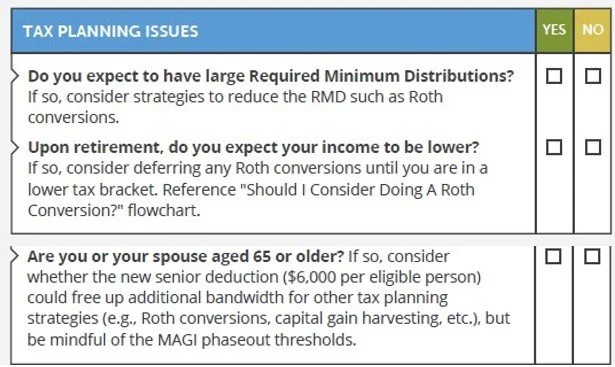

A hot topic for tax planning lately among clients is Roth conversion strategy. Some advisors will tell you that it’s solely based on what your tax bracket is now versus what it will be in the future. But consider three points that make that point of view limited.

One. When you convert from tax-advantaged (like a 401k, or a traditional IRA account) to tax-free savings, all the future growth generated from that wealth is tax-free too. And that wealth could be generating growth for the 18 to 20 years you are spending in retirement. When you save in a tax-advantaged account, the growth, while wonderful, is going to be taxed when you withdraw it. Or when your heirs withdraw it.

Two. No one can say with 100% certainty what tax brackets might be in the future when you start taking your RMD’s. And ten years after you start taking your RMD’s. And five years on from that.

Three. Think about what happens to your tax bracket when a spouse passes away. All that wealth you’ve accumulated throughout your life is now being looked at through a lens of a single filer for the remaining spouse. And ladies, that’s often you. In a National Institute of Health study, women were shown to spend 3.8 years longer in retirement than men, on average. Not only that, but the same organization says that healthcare spending is higher for women during retirement. Having your income taxed at single filer bracket can cost a lot!

Let’s look at an example. Say your married-filing-jointly income is $250,000 a year between your investment income, two social security checks and your required minimum distributions from your retirement savings as a married couple. Then, sadly, your spouse passes away. So now, you lose your spouse’s social security, but you’ve got all the retirement assets and income remaining, thank goodness. And your RMD climbs a bit because you’ve gotten a bit older. Your new retirement income is now $200,000. Now, instead of your marginal tax rate of 24% as a married fling jointly, it’s 32% as a single filer (using current tax brackets as an example). Ouch! That Roth conversion looks a little different in this light!

Of course, one of the smartest times to convert can be after you retire (sometimes even starting in the year in which you retire), but before you start collecting social security and before you have to take your RMD’s. But it can be a good option to start converting sooner. I’ll help you look at your specific situation and make an informed decision.

It’s good to have a plan, and someone to talk to with the knowledge and resources to help. I’m here for you.

Important Disclosure Information: This blog is published by Prosperity Financial Planning LLC, a registered investment adviser with the state of Florida. Registration does not imply a certain level of skill or training.

General Information Only: The content provided is for general informational and educational purposes only and should not be considered personalized investment advice. Nothing contained in this blog constitutes a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments.

No Investment Advice: This content does not constitute investment advice and should not be relied upon as such. Any investment decisions should be made only after consulting with qualified financial professionals. Past performance does not guarantee future results.

No Warranties: While we strive to provide accurate information, we make no representations regarding the accuracy, completeness, or timeliness of the content. We do not endorse third-party information and are not responsible for external websites or resources.

Risks and Relationships: All investments involve risk of loss. Reading this blog does not create an advisory relationship with Prosperity Financial Planning. Advisory relationships are established only through execution of a formal investment advisory agreement.

For more information about our services and important disclosures, please refer to our Form ADV Part 2A, available upon request or at www.adviserinfo.sec.gov.

Contact Information Prosperity Financial Planning LLC, Celebration, Florida. elizabeth@prosperityfinancialplanning.com