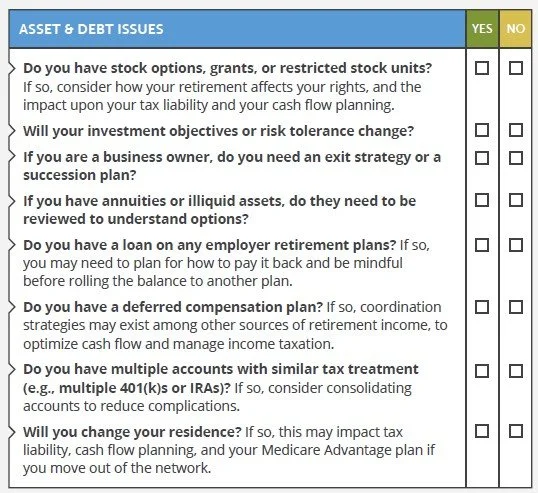

#3 Asset & Debt Issues

This is a series about the 6 key things to consider before you retire. If you would like to consider building a personalized Prosperity Financial Plan, don’t hesitate to reach out. Schedule a Meeting

#3: Asset & Debt Planning Issues

Your accumulated assets can create an income stream for retirement by throwing off dividends, interest, rents, income payments or royalties, or even through the sale of the assets to create needed funds. Asset allocation (e.g. stocks, bonds and cash) should be set up to support both income and needed growth to outpace inflation. And don’t forget to factor in tax-efficiency with asset location. Having the right assets in the right types of accounts can really pay off. There is an art and a science as to what goes where in taxable, tax-deferred and tax-free accounts, used strategically to yield the cash flows needed throughout your life and keep your taxes to a minimum.

Liquidity needs to be part of the equation too. The right level of liquid assets available when you need them can give you peace of mind when you might need it most. That could be during market volatility, which we’ve seen this year more than usual. Your risk profile comes to the forefront here. That includes BOTH risk tolerance (how you feel about risk) and risk capacity (how much risk do you need to take).

Entering retirement with significant debt in car loans, credit cards, parent plus loans, 401k loans or second mortgages can put unnecessary pressure on your assets. Any debt you carry into retirement needs to be factored into cash flow. Whether you are a Dave Ramsey debt snowball fan, or the debt avalanche method (see this link from Investopedia), debt payments need to be in your plan, and likely for as short a time as possible.

It’s good to have a plan, and someone to talk to with the knowledge and resources to help. I’m here for you.

Important Disclosure Information: This blog is published by Prosperity Financial Planning LLC, a registered investment adviser with the state of Florida. Registration does not imply a certain level of skill or training.

General Information Only: The content provided is for general informational and educational purposes only and should not be considered personalized investment advice. Nothing contained in this blog constitutes a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments.

No Investment Advice: This content does not constitute investment advice and should not be relied upon as such. Any investment decisions should be made only after consulting with qualified financial professionals. Past performance does not guarantee future results.

No Warranties: While we strive to provide accurate information, we make no representations regarding the accuracy, completeness, or timeliness of the content. We do not endorse third-party information and are not responsible for external websites or resources.

Risks and Relationships: All investments involve risk of loss. Reading this blog does not create an advisory relationship with Prosperity Financial Planning. Advisory relationships are established only through execution of a formal investment advisory agreement.

For more information about our services and important disclosures, please refer to our Form ADV Part 2A, available upon request or at www.adviserinfo.sec.gov.

Contact Information Prosperity Financial Planning LLC, Celebration, Florida. elizabeth@prosperityfinancialplanning.com