#2 Healthcare and Insurance

This is a series about the 6 key things to consider before you retire. If you would like to consider building a personalized Prosperity Financial Plan, don’t hesitate to reach out. Schedule a Meeting

Download Before You Retire Checklist

#2: Healthcare and Insurance Needs

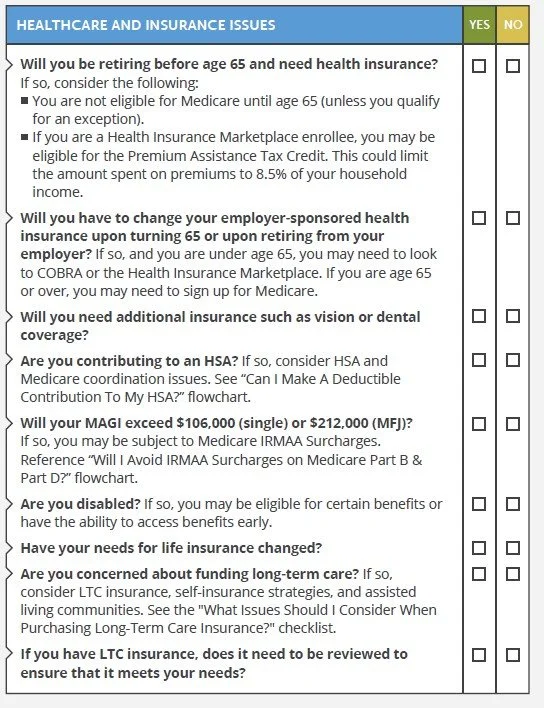

Retirement planning must account for insurances, and especially healthcare insurance, Let’s breakdown what you need to know before it blocks the cash flow stream we talked about last time.

If you are planning to retire before age 65, mind the gap! The magical 65th birthday month, when Medicare becomes available to you, is one of the best things about that age. And how big the gap is depends on how soon you retire prior to that date. I’ve advised a bunch of clients that were subscribing to the FIRE movement. You know, Financial Independence, Retire Early. While it’s nice to think about life without the need for a paycheck, retiring early takes a LOT of planning…and confidence in your plan. Most folks I’ve advised can bridge the chasm with come careful planning. There may be options for you that you may not have thought about. Do you qualify for COBRA after you leave your employer? Maybe that will get you part or all the way there. If you’re married and your spouse is working, perhaps they have coverage that can add you. Or maybe you look for part time work that offers some benefits (those companies are hidden in the field behind the unicorn pens.) HSA’s can be another nice option to max out and potentially use for healthcare premiums in the gap.

Health insurance can be really expensive in the open market, so best to explore all options before pulling the retirement trigger. (Here’s a link to the legit government site for estimating open market costs.) And once you retire, there may be other insurances you can alter, like disability and life insurances. So it’s important to carefully look at your needs and expenses during your planning process.

It’s good to have a plan, and someone to talk to with the knowledge and resources to help. I’m here for you.

Important Disclosure Information: This blog is published by Prosperity Financial Planning LLC, a registered investment adviser with the state of Florida. Registration does not imply a certain level of skill or training.

General Information Only: The content provided is for general informational and educational purposes only and should not be considered personalized investment advice. Nothing contained in this blog constitutes a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments.

No Investment Advice: This content does not constitute investment advice and should not be relied upon as such. Any investment decisions should be made only after consulting with qualified financial professionals. Past performance does not guarantee future results.

No Warranties: While we strive to provide accurate information, we make no representations regarding the accuracy, completeness, or timeliness of the content. We do not endorse third-party information and are not responsible for external websites or resources.

Risks and Relationships: All investments involve risk of loss. Reading this blog does not create an advisory relationship with Prosperity Financial Planning. Advisory relationships are established only through execution of a formal investment advisory agreement.

For more information about our services and important disclosures, please refer to our Form ADV Part 2A, available upon request or at www.adviserinfo.sec.gov.

Contact Information Prosperity Financial Planning LLC, Celebration, Florida. elizabeth@prosperityfinancialplanning.com