#6 All the Other Things To Consider

This is a series about the 6 key things to consider before you retire. If you would like to consider building a personalized Prosperity Financial Plan, don’t hesitate to reach out. Schedule a Meeting

#6: All Other Issues To Consider

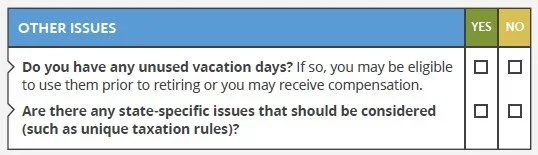

The truly resilient retirement strategy accounts for the less-obvious factors that shape long-term security. We’ll start with job-related items to think about while you are still employed. And the state where you live (or ultimately will live) is an important consideration.

Employer Considerations

First, check to see if you are eligible for COBRA healthcare insurance and how much it costs. If you are going to change insurances to a spouse’s plan, what’s required from their company to do so? What are the rules for your workplace savings upon leaving employment?

There are pros and cons about where to keep your retirement savings. Start out by asking about your options with your employer. Can you keep the funds in the company plan, or will you be required to roll them over to another plan? What happens to your company match funds if they are not fully vested? If you have company stock, options or grants, what is the impact when you leave? How much notice do you need to give your employer about your coming retirement? Are you helping prepare a successor? Are there part-time options for you (if you want to do that!)? How about consulting? These questions take some thought and review.

State Retirement Tax

Another facet to the retirement gem is state-specific. Different states tax retirement income in different ways. Some states tax social-security benefits, pension and retirement savings. Others don’t. State sales and property taxes can be a chunk out of your cash flow that needs to be accounted for in the plan. Estate and inheritance taxes (two different things!) differ by state and can be seen on this chart from the TaxFoundation.org website. Maryland, for example, charges both depending on the value of your estate and to whom you leave it. And if you plan to live in two states during retirement, you’ll need to understand the residency rules of both states for income, sales, estate and inheritance tax purposes. Watch out for statutory residency if you spend too many days in a high-tax state!

It’s good to have a plan, and someone to talk to with the knowledge and resources to help. I’m here for you.

Important Disclosure Information: This blog is published by Prosperity Financial Planning LLC, a registered investment adviser with the state of Florida. Registration does not imply a certain level of skill or training.

General Information Only: The content provided is for general informational and educational purposes only and should not be considered personalized investment advice. Nothing contained in this blog constitutes a solicitation, recommendation, or offer to buy or sell any securities or other financial instruments.

No Investment Advice: This content does not constitute investment advice and should not be relied upon as such. Any investment decisions should be made only after consulting with qualified financial professionals. Past performance does not guarantee future results.

No Warranties: While we strive to provide accurate information, we make no representations regarding the accuracy, completeness, or timeliness of the content. We do not endorse third-party information and are not responsible for external websites or resources.

Risks and Relationships: All investments involve risk of loss. Reading this blog does not create an advisory relationship with Prosperity Financial Planning. Advisory relationships are established only through execution of a formal investment advisory agreement.

For more information about our services and important disclosures, please refer to our Form ADV Part 2A, available upon request or at www.adviserinfo.sec.gov.

Contact Information Prosperity Financial Planning LLC, Celebration, Florida. elizabeth@prosperityfinancialplanning.com